|

| Tips to decide Buy or rent a house |

Entering 2021, the world's economic and business conditions do not seem to improve, as the pandemic continues. In the meantime, basic human needs will undoubtedly go on. In order to sustain life's necessities by 2020, it seems incredible, facing 2021 would be even more challenging. How do we provide for the necessities of life above the necessities of having a home.

If the economy is stable, we can easily decide. Because back then all the companies were in stable condition. And what about the year 2021? Deciding whether to buy or rent a house is no longer easy. Many countries declare economic recession, and it also affects our decisions to buy or rent a house. Since you decide to buy or rent, it's going to cost you a lot of money. We can't afford to make any wrong decisions. Due to the slightest irregularities, it will affect our finances over the next few years.

Perhaps before the recession and the pandemic shook the world economy, you had prepared plenty to buy a house by mortgage. Maybe you guys are tired of the rent. But now is in doubt because of the change in mortgage value of various fund providers. Not all the mortgage on the purchase of the house was profitable. Could be a better rent. Having the mortgage is usually called renting the house itself.

Posted on the CNBC.com titled "Where owning a home is cheaper than renting one". We can read, which is cheaper between having a rundown or renting a house? Diana Olick from CNBC said, The answer is depending on where you live.

In the lower-end homes now we found highly competition, because of a combination of low mortgage rates and record low supply, is bringing the prices of house higher.

CNBC.com also mentioned Birmingham, Alabama; Pittsburgh; Jacksonville, Florida; Oklahoma City; St. Louis; Tampa, Florida; Atlanta; Miami; and New Orleans all showed monthly home payments that were significantly cheaper than the median monthly rent.

On the other areas, cities in the West dominated the list of markets where it is cheaper to rent than own a home. That is because home prices in the West are some of the highest in the nation. for example, California claimed the top four spots, with San Jose, Los Angeles, San Francisco and San Diego favoring renting costs over owning. this is make us think twice for buy a house.

Let's look at the mortgage expert's opinion

Reporting from freddimac.com website titled "mortgage forbearance during the covid-19 crisis", has been summed up as follows:

Mortgage forbearance has played an important role in protecting borrowers affected by the COVID-19 pandemic by providing them with liquidity when they need it most. Millions of families have been able to stay in their homes with the financial relief provided through mortgage forbearance. Without forbearance, many of these households would have been forced to sell their homes or would have defaulted on their mortgages, which, in turn, could have depressed the housing market, leading to further defaults in a vicious cycle.

We have examined the variation in forbearance rates in mortgages funded by Freddie Mac across three periods and by several key variables. We have shown that the rate of mortgage forbearance during the COVID-19 crisis is similar to the rate seen in the 2017 Storms period, but much higher than the Baseline sample for the 14 months preceding the COVID-19 crisis. During the COVID-19 crisis and the 2017 Storms, many households likely viewed their situation as a temporary liquidity shortfall and so chose forbearance as their best financial strategy. We have also illustrated the relationship between forbearance rates and important borrower and loan characteristics: FICO score, DTI ratio, LTV ratio and monthly payment.

Looking at all this explanation, it might be a bit overwhelming for those of you who don't work in economics. But deciding to buy a house or rent would also be easier to calculate with a mortgage calculator. This calculator can be reliable enough to see the true economic condition we live in now, whether it is capable of making a home mortgage or renting only one house during the covid19 pandemic is not over.

Let's use the mortgage calculator

According to me personally the website Mortgagecalculators.info may finally help decide whether to decide buying the house with the cash, mortgage or renting it. For those who don't have the cash, the final option is on mortgage or the rent. So, the calculator on the website Mortgagecalculators.info has a well-calculated basis for calculating the expense breakdown. It also help you to check, how much income do you need to earn to buy a house.

|

| Mortgagecalculators.info |

By this calculators, we can figure out your FULL actual mortgage cost including HOA fees, PMI, property taxes, homeowner's insurance & routine maintanence expenses. it will shows completely. if you guys having any loan origination or discount points, you can put into the loan. after that, you can estimate the value of your home at the end of your loan term. the number that shows in this mortgage calculators will helps you a lot for making the decision. Mortgagecalculators.info also serve you advanced calculator if you guys looking for more in-depth payment estimate.

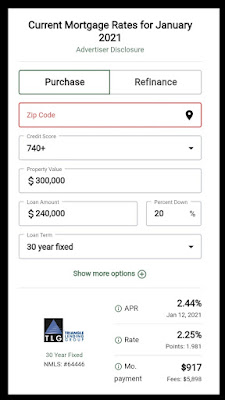

I'm not always believes what experts say, I prefer to see the immediate count of what profits or objections I will endure if I have to buy or lease a house. Besides, with these calculator on mortgagecalculators.info, we can also leverage current local mortgage rates to lock-in savings. How do I say this is local rates? Because the rates counting by the zip code area where you lived in. if you live in different city, it will showed different rate for purchase or refinance. I think it makes the mortgagecalculators.info different than the other calculators that tend to calculate equally.

|

| Current mortgage rates |

Having found a number that approached my current condition, then I would compare the level of my ability with the experts' opinions. On mortgages I've seen my financial mortgages for the next 30 years. Experts' opinion provides the basis for how secure the situation will be.

Mortgage makes a dream of owning a home a reality for people who can't pay hundreds of thousands of dollars in cash up front for a house. As you spread that around for decades, buying a house became much more affordable. But on the other hand, we should also remember that the mortgage tends to be expensive. Another weakness that comes with a mortgage is that you have made a commitment to the lender to make monthly payments for long decades. If there's ever a time when you can't pay, then there's foreclosure on your house. It lowers your credit score and can make you more difficult to get loans in the future maybe one day you need for starting business or something else.

On the whole, I like the website mortgagecalculators.info very much for helping many peoples make the decision about mortgage. But I hope that someday the mortgagecalculators.info can help us calculate for all countries, not just on $ basis, but on the amount of money from various countries.

Of all the things I've told you, are you guys gonna try on mortgages calculators? Don't just believe what I say before you try it too. Then the results come in, you match them with experts' opinions. Do not wait too long to decide whether you will buy or rent a house. Our economic conditions are all worrisome because of the pandemic Covid-19, but we should constantly be concerned about where we live because buying or renting a house is fixed cost and also our future assets.

Thankyou mbak Ruli for the nice article, yup! I can say that this website is really helpful for many people who can't make a decision about their house (buy, mortgage or rent a house)

ReplyDeleteWaaah aku baru tau tentang Mortgagecalculators.info

ReplyDeleteDulu mau beli rumah pun hitung sendiri. Biasanya juga ada salah. Sangat membantu yaa kalau ada Mortgagecalculators.info ini

Wah membantu banget nih ya kalkulator mortgagenya kalau kita mau beli rumah dengan nyicil

ReplyDeleteBagaimanapun, lebih baik beli rumah daripada nyewa. Kecuali untuk rumah kedua dan ketiga ya.

ReplyDeleteMbaaa, ke mana aja dirikuuuhh

ReplyDeleteKok aku baru tau ada solusi jitu serba/i rumah, yaitu Mortgagecalculators.info

Pentiiing banget nih, especially buat generasi millenials ya

Saya tim yang lebih memilih sewa rumah dan beli tanah. Lalu bangun rumah impian secara perlahan. Bayangin nyicil... sudah mules duluan. Hehehehe

ReplyDeletePengennya beli tanah dan bangun rumah sendiri, apa daya skrng mampunya msh ka pe er haha

ReplyDeleteWah kyknya menarik kalkulator mortgage ini mbak, kapan2 bisa kalau mau punya properti kedua hitung2annya pakai ini buat proyeksi mampu ngambil apa gak hehe

Moga ada aja nanti rejekinya aamiin

Sangat membantu yaa kalau ada Mortgagecalculators.info ini setidaknya cek en ricek harga, jangan asal²an pengaruh agen rumah...

ReplyDeleteAku dan suami pengennya beli rumah cash, tapi apa daya belum mampu. Semoga dilancarkan aja deh rezekinya, hehe. Aamiin.

ReplyDeleteBtw aku baru tau dong tentang Mortgagecalculators.info ini. Pasti sangat membantu para milenials ya dalam memutuskan untuk beli atau sewa rumah :)

wah ... ini beneran memudahkan pertimbangan saat memutuskan tentang rumah. Tapi pengalaman sih diriku lebih suka membeli, paling ngga kalau mau renovasi ngga mikir hehehehe

ReplyDeleteMemang kudu diperhitungkan dulu ya kak kalau membeli sesuatu begitu pula dengan membeli rumah. Jujur saja saya lebih suka beli rumah daripada sewa soale kalau sewa wes mumet bayar bulanannya hehe.

ReplyDeletePenting banget emang kalau mau properti apalagi rumah atau tanah harus diitung bener. Ini kalkulatornya sangat membantu.

ReplyDelete